SERVICES

Avila Consultants: Strengthen Procedures and Reduce Risks

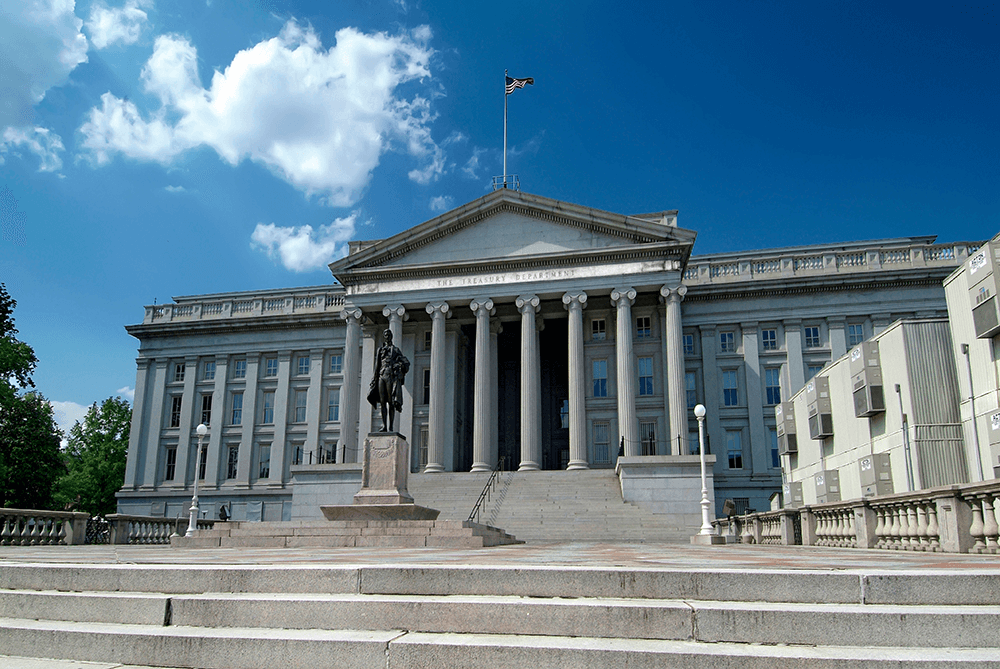

We mitigate operational and regulatory risks through customized methods based on American compliance standards, data science, and best practices.

We optimize procedures, reduce costs, and boost productivity with tailored solutions from experts with real-world experience in financial and government institutions.

We Have the Expertise

Utilizing effective methodologies to obtain accurate results

We have vast experience in public and private sectors

Reducing costs and improving productivity

1. Regulatory Compliance

Compliance Program

Investigations

We conduct investigations related to fraud, bribery, and corruption in all types of industries.

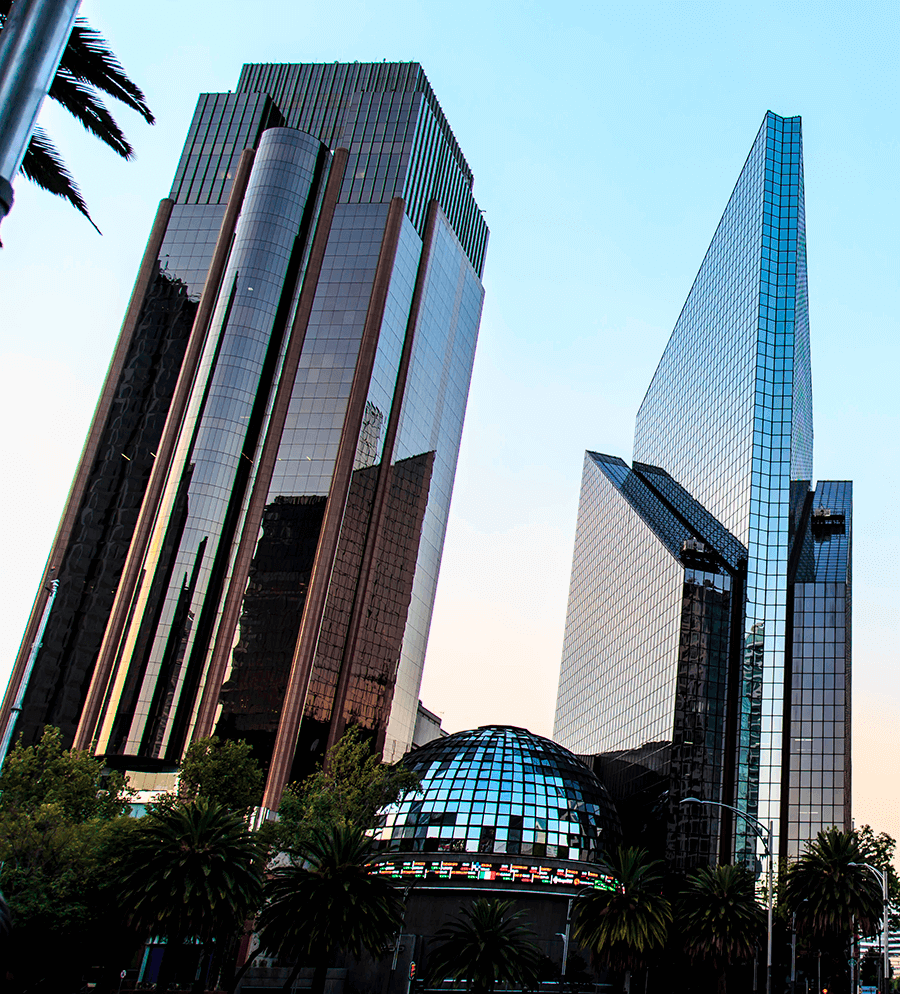

2. Financial Crimes

Compliance Program Assessments

Enterprise AML Risk Assessment

Cryptocurrency Risk Assessment

Customer Risk Assessment

Selection of IT Tools

We test functionality and compatibility of service providers so that our clients can invest in optimal vendor solutions that fully meet their requirements.

Accurate fine-tuning of transactional monitoring systems

We set up rules to optimize suspicious activity reports using data science analysis.

Customer Risk Assessment

3. Quality Assurance

Formulate Policies and Procedures

Prepare comprehensive handbooks to systematize operations and ensure core functions endure consistently over time.

Quality checks

4. Correspondent banking

Our experience

“Unidentified risks substantially impact risk exposure. Conducting an independent professional risk assessment prevents conflicts of interest and clears the way for appropriate and more effective risk management.”